Do you ever wonder how others accumulate wealth or how they always seem to have the funds, or access to funds, to invest in opportunities when prices seem attractive? The opportunity could be something as small as a high-ticket item on sale or as large as buying an entire business. The ability to wield this kind of power doesn’t just happen. Creating the power to act on opportunities, now known or not currently known, is the result of planning, discipline, sacrifice, and balance, but the “pain” might require less brawn and more mindset than you believe. Financial liquidity creates the power to act, but what is financial liquidity, and how does the concept work?

To explore the concept of financial liquidity, let’s first start with some definitions.

Financial liquidity is technically the concept of how efficiently (time and cost) an asset can be converted into cash or near cash. For purposes of this article, we’ll define financial liquidity as items such as a Treasury Bill, Treasury Note, bank certificate of deposit, money market savings, savings, or checking accounts, physical currency, or immediate access through a line of credit.

Harnessing and understanding the power of liquidity allows an individual to build a better future in their financial journey. So, how do you harness the power of liquidity?

Power in Practice

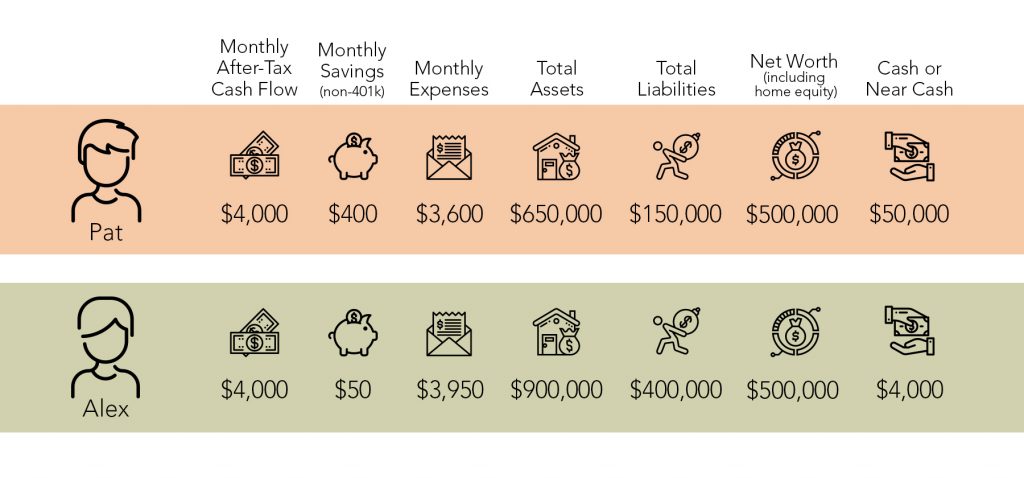

Let’s take Pat and Alex as an example to provide a mental framework for the power of liquidity:

Alex teases Pat because Pat leaves so much cash on deposit at the bank. Alex claims that keeping money lying around is lazy and doesn’t provide the highest return, which is probably true and reflects the cost of liquidity in reserve for opportunities.

In a few scenarios, Alex is probably right. Pat could get higher returns by investing in a private company or a partnership; however, what happens when something unexpected comes around the corner?

In a few scenarios, Alex is probably right. Pat could get higher returns by investing in a private company or a partnership; however, what happens when something unexpected comes around the corner?

Sure, Pat and Alex are covered if they have to put in an insurance claim for a minor plumbing repair or replace a minor appliance in their home.

Sure, Pat and Alex are covered if they have to put in an insurance claim for a minor plumbing repair or replace a minor appliance in their home.

However, what if a major catastrophe happens, or we hit a recession? In these cases, Alex may have to sell assets at sub-optimal prices to avoid bankruptcy. Furthermore, in a recession scenario – Alex may not have a $500,000 net worth by being forced to sell holdings at lower pricing to create the needed financial liquidity. Pat, on the other hand, with a 10% net worth in cash, can carefully consider alternatives and easily maneuver with more choices and time.

However, what if a major catastrophe happens, or we hit a recession? In these cases, Alex may have to sell assets at sub-optimal prices to avoid bankruptcy. Furthermore, in a recession scenario – Alex may not have a $500,000 net worth by being forced to sell holdings at lower pricing to create the needed financial liquidity. Pat, on the other hand, with a 10% net worth in cash, can carefully consider alternatives and easily maneuver with more choices and time.

What if an investment opportunity comes along, like a small triplex with rentals and excellent cash flow? Pat would have instant access to liquidity and credit, while Alex would have a harder time increasing their net worth.

What if an investment opportunity comes along, like a small triplex with rentals and excellent cash flow? Pat would have instant access to liquidity and credit, while Alex would have a harder time increasing their net worth.

For Pat, liquidity provides opportunity. For Alex, the opportunity is minimal.

Sure, each of these illustrations could have many variables, but in these simple illustrations, we can see and understand the power of financial liquidity in an uncertain future.

“If you have a net worth, but no financial liquidity, you may have less net worth than you believe. Likewise, when you have financial liquidity, opportunity will seek you out. Liquidity is Power.”

As a further example in our current pandemic situation, let’s assume Pat and Alex are laid off, and unemployment only covers half of their current after-tax income. How would each of them survive if everyone were trying to solve cash flow problems by selling assets? As the values drop, participants would have to sell at sub-optimal prices. Who wins when valuations drop? Who loses?

In this example, Pat would be able to stay afloat for several months with lower expenses, less debt, slowing savings deposits, and use of cash reserves. Pat could purchase groceries, negotiate with neighbors, or barter for goods using emergency liquidity. However, with fewer choices, Alex would face harder choices.

In this example, Pat would be able to stay afloat for several months with lower expenses, less debt, slowing savings deposits, and use of cash reserves. Pat could purchase groceries, negotiate with neighbors, or barter for goods using emergency liquidity. However, with fewer choices, Alex would face harder choices.

As you can see in these examples, liquidity is also a safety net and a vital portal to a better future for you and your family.

Maximizing Liquid Assets

Liquid assets are those that you can turn into cash relatively quickly. The spectrum of assets considered liquid is vast; however, currency in a jar or mattress could be regarded as the most liquid asset, meaning you can immediately spend it. However, physical currency and commodities are the least secure because they can be destroyed by fire, misplaced, or stolen. On the other end of the scale are assets such as real estate, which can take months or even years to convert into cash.

When it comes to storing liquid assets, here are some familiar places people choose to keep their money:

- Their Home

- Checking Accounts

- Money Market Accounts

- Short-term Certificates of Deposit

- United States Treasury Bills

Remember, for purposes of this article; we define financial liquidity as cash or near cash.

In most cases, depositing your money in a federally insured bank is considered extremely safe. Bank deposits have not been frozen since 1933 when President Roosevelt declared a “banking holiday,” which lasted a week and led to the modern FDIC-insured banking system. Additionally, depositing cash into a local community bank where you can enjoy the benefit of a personal relationship is wise because a local professional provides personal service and local insight. If you do most of your banking with an account held at a remote or online provider, you risk varying impersonal service, or you may have problems reaching your funds if major systems should shut down.

Money market mutual funds can cause problems because you are taking price risk since the future of the market is unknown, and your principal could become worthless. Also, you could lose access to your cash if financial markets shut down – like what happened to many investors on September 11, 2001.

For emergency purposes, stocks, bonds, mutual funds, annuities, or insurance policies are not considered liquid assets. In addition to normal market fluctuations, these instruments may become completely illiquid if markets shut down or have no buyers.

If you’re looking to learn how to maximize liquid investments, consider our recent article, Increase Income and Reduce Risk: Rethinking Your Certificates of Deposit Strategy. Certificates of deposit are insured per tax ID number up to $250,000, and no CD investor has ever lost on FDIC insurance so long as they are under the insurance limit.

The amount of liquid assets you should consider maintaining depends upon your after-tax income, monthly expenses, and other personal factors. Reach out to a financial professional, like your banker, to discuss your specific situation.

Liquidity maintenance is a balancing act: you should be able to support yourself and your family for up to six months in an emergency. Another rule of thumb is to maintain liquidity of at least 10% of your estimated net worth. While asset liquidity can be more complicated than some of the examples we have provided, harnessing the power of liquidity can help keep you build a better future and keep you financially secure during uncertainties.

By: Greg Larson, President & CEO, Drake Bank

@DrakeBankLeader