While fixed income investing can offer the investor less risk than stocks and provide a steady stream of interest income, many individual depositors do not have the resources to experience the same benefits as market professionals. However, by using certificates of deposit (CDs) individual depositors can achieve benefits similar to those from a professionally managed portfolio.

For over a century, fixed income portfolio managers have successfully used a combination of three basic tactics for managing high-net-worth and institutional fixed income portfolios. Applying these same principles to a CD portfolio, can increase your income and reduce risk. However, as with any investing strategy, these tactics are not risk-free.

Know the Risks

Fixed-income investors face liquidity risk, credit risk, call risk, and interest rate risk. Before we talk strategy and tactics, let’s start by understanding fixed-income risks relative to CDs.

Risk Mitigation Strategies and Tactics

With a CD portfolio, you can reduce risk and maximize income based on an individual’s risk and return needs by using a fixed income investment strategy. The strategies below take time and effort for the potential benefit to unfold. However, if a depositor is willing to take initiative, plan, and execute, these strategies can be beneficial for long-term gains.

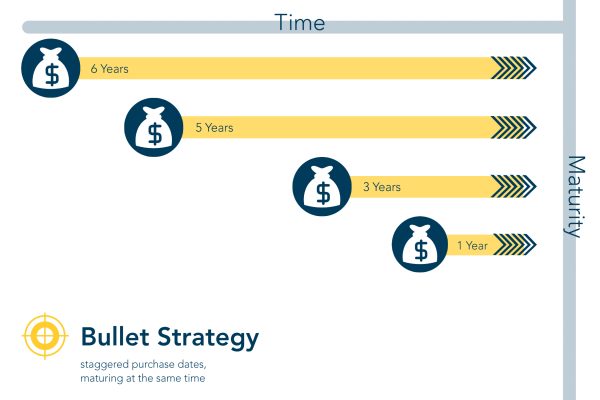

The Bullet Strategy

The Bullet Strategy

Purpose: If a certain amount of capital at a future point in time, the bullet strategy might be the right choice.

Purpose: If a certain amount of capital at a future point in time, the bullet strategy might be the right choice.

Overview: The bullet strategy staggers purchase dates, so the certificates mature at the same time. This technique is similar to an approach municipality uses to pre-refund a bond issue.

Pros: By staggering the purchase of bonds, a depositor can more efficiently seek out conditions offering a variety of interest rates. Since all the certificates mature at the same time, depositors may receive a more attractive inflow at maturity.

Cons: Because the depositor is staggering the purchase of the certificates, the depositor must accept the risk that interest rates will fall over the purchasing period. Keeping a close eye on interest rates and market conditions is critical for this strategy.

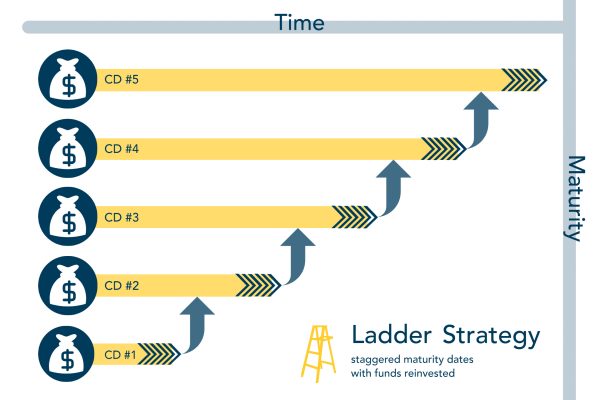

The Ladder Strategy

The Ladder Strategy

Purpose: Diversifies a depositor’s CD portfolio by providing flexibility and spreading the deposits over different maturities and interest rates. The ladder strategy increases the depositor’s liquidity since at least one CD is always relatively close to maturity.

Overview: The ladder strategy staggers CDs over time with varying dates of maturity. The diversification prevents a single lump sum of funds from entrapment in a single certificate over a long period. As each CD matures, funds are reinvested to maintain yield and take advantage of higher rates.

Example: If a depositor has $100,000 to deposit in CDs, they may invest $10,000 in ten CDs that mature incrementally every six months for five years. As each CD matures, the depositor rolls the maturing CD principal into the next maturity.

Pros: The ladder strategy can be implemented with any dollar increment and any maturity so long as the depositor maintains the approach. In a rising interest rate environment, the depositor is always increasing the rate of the portfolio.

Cons: If interest rates fall, funds can be used to maintain the strategy but convert to a more extended maturity ladder to maintain yield.

The Barbell Strategy

The Barbell Strategy

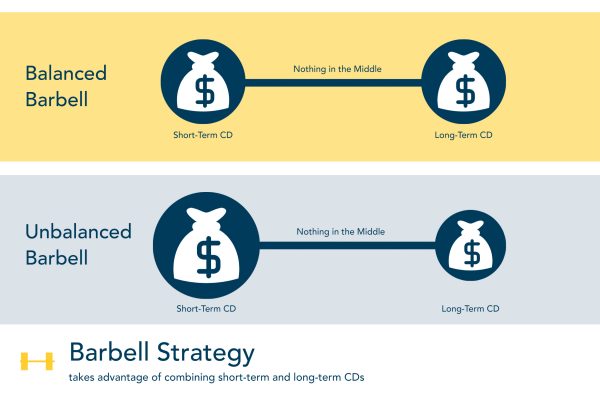

Purpose: Takes advantage of the best aspects of both short-term and long-term CDs to benefit from flexible liquidity while receiving a steady flow of income.

Overview: The barbell strategy combines the use of short- and long-term CDs to create opportunities for rising rates in conjunction with higher yields.

Example: If a depositor has $100,000 to deposit in CDs, they might deposit $50,000 in a six-month CD coupled with a $50,000 five-year CD. This example is known as a “balanced barbell.” An “unbalanced barbell” might include a $75,000 six-month CD coupled with a $25,000 five-year CD.

Pros: In a falling rate environment, the long-term CD offers above-market interest income over a long period.

Cons: By not having all your funds in long-term CD, the depositor limits the downside effects if interest rates were to rise during the holding period.

The Bottom Line

Regardless of which strategy a depositor chooses, each CD investment approach has benefits and drawbacks depending on their preferences and market interest rate volatility.

The features, advantages, and benefits of investment in CDs using fixed income strategies can offer the depositor increased income, decreased cost, reduced risk, straightforward execution, and increased “peace of mind” versus other market instruments.

It is important to note, the benefits of these strategies are typically not seen in the short term; patience and commitment are essential. For those willing to put in the time and effort, taking an extra step in protecting your portfolio from interest rate risk could help the dedicated and determined depositor build a better future.

By: Greg Larson, President & CEO, Drake Bank

@DrakeBankLeader