Positive Pay

How It Works

Accessing Positive Pay

Follow these steps if you are an authorized user for Positive Pay.

- 1Log into business online or mobile banking1

- 2Via online banking, select the ‘Checks & Deposits’ tab and then ‘Positive Pay’

- 3Via mobile banking, select ‘Approvals’ then ‘Positive Pay Exceptions’

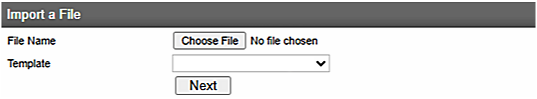

Upload an Issued Check File

- 1

Select the ‘Overview’ tab of Positive Pay

- 2

Under ‘Import a File,’ select ‘Choose File’

- 3

Select a saved file from your computer; it must be in .csv comma delimited format

- 4

Select the template from the drop-down menu. If you don’t have a template created, contact our team for support.

- 5

Click ‘Next’

- 6

If the file is uploaded successfully, a green banner will appear. If errors exist, a red banner will appear, indicating the errors.

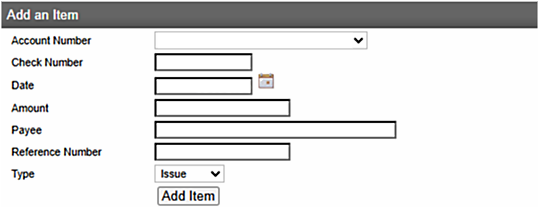

Manual Check Entry

- 1Select the ‘Overview’ tab of Positive Pay

- 2Under ‘Add an Item,’ select the account number for the check being entered

- 3Enter the check information (i.e., check number, amount, payee)

- 4Skip the reference number

- 5

Under Type, select ‘Issue’ for new checks

- 6Select ‘Add Item’

- 7If the check is entered correctly, you will see a green banner indicating it was successful. If errors exist, a red banner will appear, indicating the errors.

Frequently Asked Questions

Additional Resources

1 Mobile banking can be used to decision exceptions; other Positive Pay functionality requires Online Banking access through a web browser.