Fraud Text Alerts

Monitor and stop potential fraudulent debit card transactions.

We understand the importance of accessing your accounts and using your debit card at any time during the day. Fraud Text Alerts is a fast and free1 way to help monitor your debit card transactions and stop potential fraudulent purchases.

How It Works2

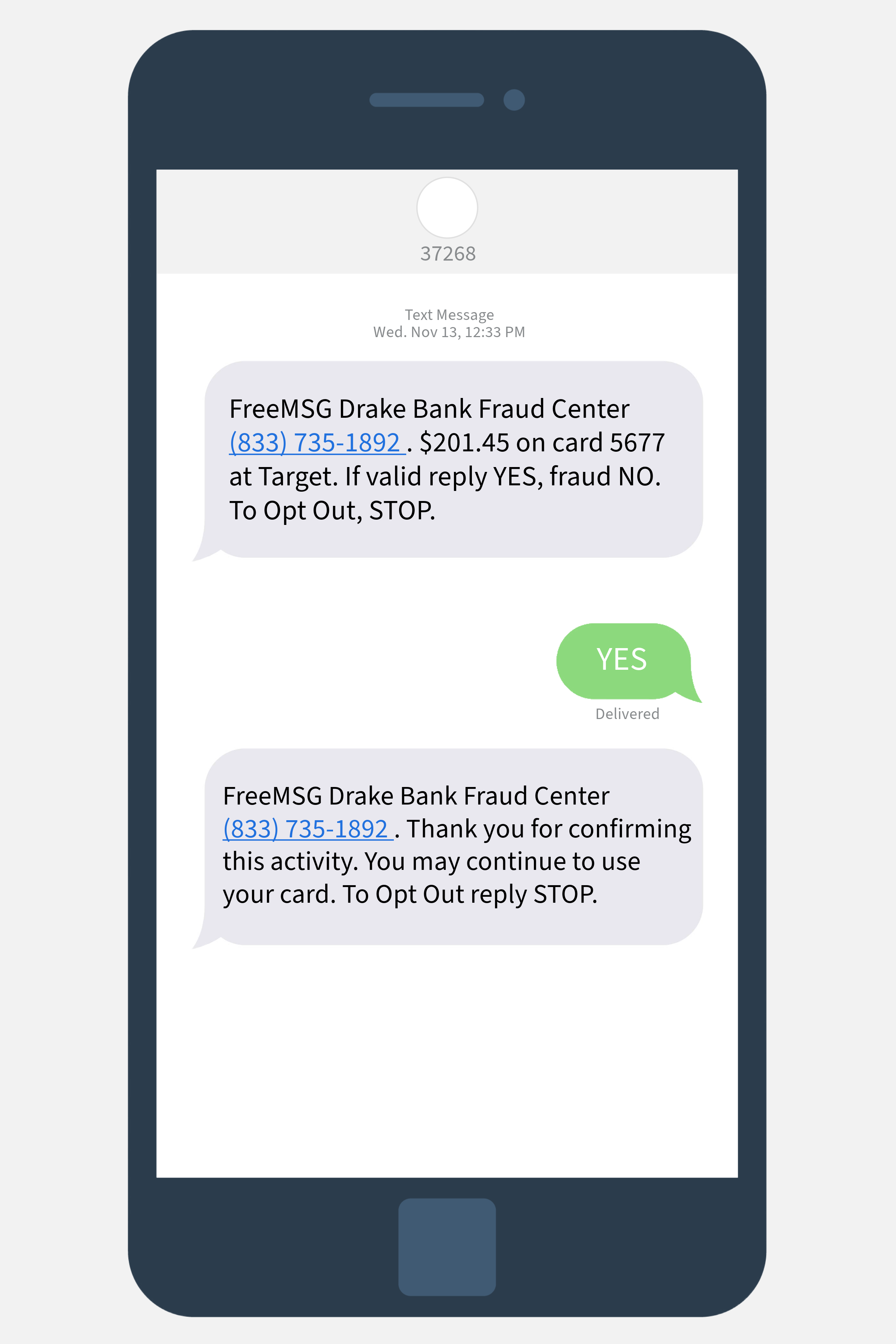

Our fraud monitoring program works around the clock,3 keeping an eye on your account and transactions. If we detect a suspicious debit card transaction, a text message is sent to you asking if the transaction is fraudulent.

REMINDER: Our fraud monitoring program uses multiple strategies and variables when determining whether a transaction is suspicious and potentially fraudulent. One variable is based on the geographic location of the transaction. Because of this, we suggest informing us of your travel plans so we can add a travel note to your account. Doing this will help avoid having legitimate charges flagged as potentially fraudulent.

NOTE: Fraud Text Alert messages will be sent from either 37268 or 20733.

Frequently Asked Questions

1 Drake Bank does not charge a fee for Fraud Text Alerts; however, standard text and data rates from your mobile carrier may apply. Messaging frequency depends on account activity. Text messages will come from 37268 or 20733.

2 Fraud Text Alerts is available to Drake Bank consumer and business debit cardholders who have mobile phone service through a participating carrier and have an active mobile phone number on file with Drake Bank. Participating mobile carriers are subject to change without notice. By providing your mobile phone number, you agree to enroll in Fraud Text Alerts and authorize text message notifications of suspected fraudulent activity.

3 While our fraud monitoring program monitors debit card transactions 24 hours a day, Fraud Text Alerts and phone calls are only sent between 8 a.m. and 9 p.m. local time, based on the debit card’s zip code. If a charge occurs after 9 p.m., the text message and/or phone call will not be sent until after 8 a.m. the following day. However, you can reach us 24/7 at (833) 735-1892 if you have any issues with your card.

Text messages may not be delivered to you if your phone is not in the range of the transmission site or if sufficient network capacity is not available at a particular time. Even within coverage, factors beyond the control of the Bank and mobile carriers may interfere with the message delivery, for which neither the Bank nor the mobile carrier shall be responsible. Mobile carriers do not guarantee that Fraud Text Alerts will be delivered. Additionally, the Bank and its service providers shall not be liable for failure to provide fraud monitoring and/or Fraud Text Alerts, and fraud monitoring and Fraud Text Alerts may not be available at any time and for any reason outside the reasonable control of the Bank, its service providers, or any third party of the Bank or cardholder.